Did you know that your union fees are tax-deductible?

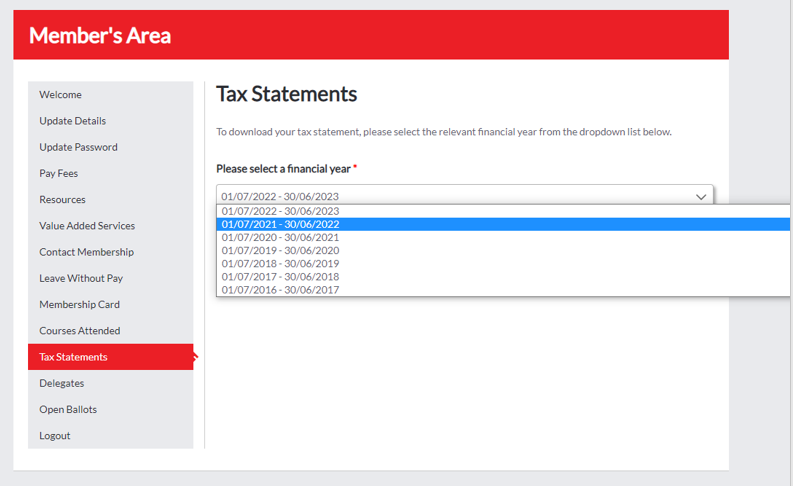

Your tax statement will be available to download from Friday 1 July 2022

- If you pay by Direct Debit or Credit Card, you can login to your member account at https://membership.psa.asn.au and follow the instructions below.

- If you pay by payroll deduction the amount will be shown on the payment summary you will receive from your employer. Your payment summary may be provided by your employer or alternatively go to MyGov. For more information on accessing your tax statement refer to the ATO’s website www.ato.gov.au/Individuals/Jobs-and-employment-types/Working-as-an-employee/Access-your-income-statement.

- If you pay via invoice you will have received a receipt at time of payment. Copies of these are also available in the Members’ Account Area https://membership.psa.asn.au.

If you have any questions regarding your Membership please email us at or call the PSA on 1300 772 679 and press option 1 to speak with our Membership Team.

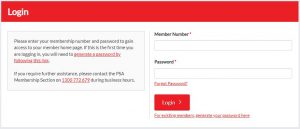

To Log in and download your Tax Statement go to: https://membership.psa.asn.au

Please ensure you use an email address which you have already provided to the PSA.

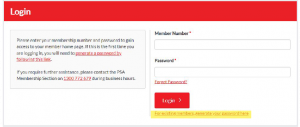

If this is your first time logging in, you will need to generate your own password: an example on where to go is below and is highlighted in yellow.

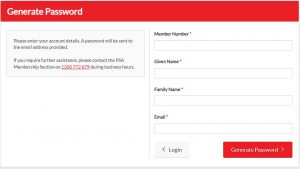

You will then be taken to the screen shown below. This is where you can enter your membership number. Your membership number is stated on the PSA/CPSU NSW bulletin you receiving on 28 June 2022.

Then enter your given name, family name and an email address.

PLEASE NOTE: For security the email address must be an email that has previously been provided to the PSA.